Probate is a process by which the courts legally recognize a deceased person's (the decedent) death, settle their outstanding debts, and distribute remaining assets to their heirs. The process is designed to facilitate the transfer of a deceased person's estate, and when necessary, to protect both beneficiaries' and creditors' interests in the decedent's estate. In Texas, probate is handled in Texas’ Probate Courts.

Here Are the General Steps It Takes to Administer an Estate and Probate a Will in Texas:

![]()

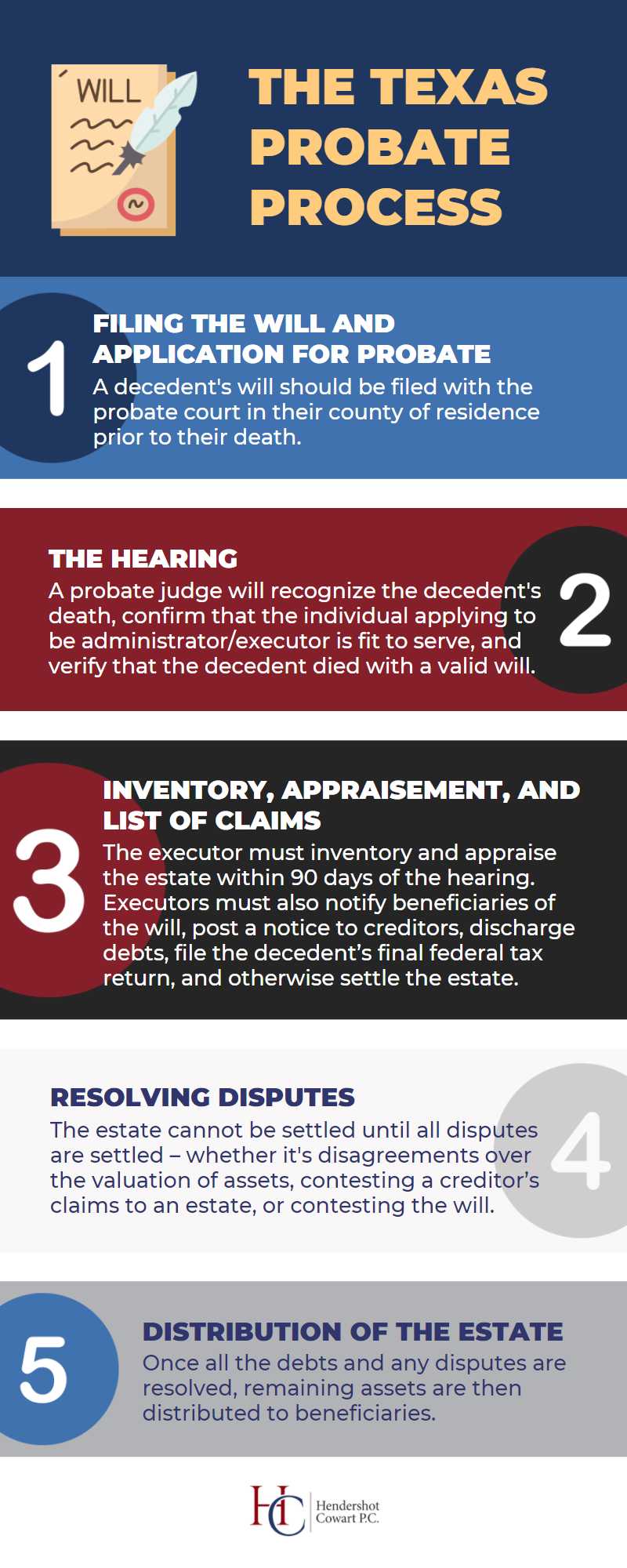

1. Filing the Will and Application for Probate.

When someone dies with an established will in place, the will must be filed with the proper court along with a written application to admit the will to probate and be appointed executor of the estate. A decedent's will should be filed with the probate court in their county of residence prior to their death. After filing the will, the clerk of the court will post a notice at the courthouse advising all interested parties the will has been filed. The notice must remain posted for at least 10 days. The purpose of this waiting period is to give those who wish to contest a will time to do so. If no one comes forward to contest the will, the courts will move forward with confirming the will's validity.

However, it is important to note that this is not the only opportunity someone has to contest a will. According to Texas law, a will can be challenged at any time after the will is offered to probate and up to two years after a will has been admitted for probate.

Do you need assistance probating a will or administering an estate in the greater Houston area? Call (713) 909-7323 to speak with an experienced, compassionate probate attorney today, or contact us online.

2. The Hearing.

The probate hearing takes place before a probate judge. During this hearing, the judge will recognize the decedent's death, confirm that the individual applying to be administrator/executor is fit to serve, and verify that the decedent died with a valid will.

The applicant seeking to be appointed executor of the estate must provide evidence confirming several important facts, including the date of the decedent's death, the location of their legal residence, that the will being filed is, in fact, the decedent's last will and testament, and that the will was correctly executed and witnessed. The executor will also swear an oath to fulfill their responsibilities and legal duties as executor.

Once the hearing is completed and all requirements are met, the judge will admit the will to probate and appoint the applicant as the executor of the estate. The clerk will then issue “letters testamentary” to the executor, which serve as notice to third parties that the executor has authority to act on the estate’s behalf.

3. Inventory, Appraisement, and List of Claims.

It is the executor's responsibility to inventory and appraise the deceased person's estate within 90 days of the hearing. Executor responsibilities also include notifying beneficiaries of the will, posting a notice to creditors, discharging debts, filing the decedent’s final federal tax return, and otherwise settling the estate. The executor may also be responsible for selling estate assets. A probate attorney can assist with many of these duties.

4. Resolving Disputes.

The estate cannot be settled until all disputes are settled – whether these are disagreements over the valuation of assets, contesting a creditor’s claims to an estate, or contesting the will. Sometimes, disputes are related to the duties of the executor. The executor is considered a fiduciary and is expected to protect and maintain the estate's assets for the beneficiaries above his or her own interests. If the heirs to an estate feel the executor is not fulfilling this fiduciary duty, they may engage an attorney to file a breach of fiduciary duty claim.

These disputes can be addressed before a probate judge but are more often settled through mediation. A probate attorney can represent your interests in any disputes.

5. Distribution of the Estate.

Once all the debts and any disputes are resolved, the remaining assets are then distributed to beneficiaries. It should be noted that not all assets pass through the probate process: joint accounts with rights of survivorship; assets with designated beneficiaries, such as retirement accounts, IRAs, and life insurance policies; property held in trust; or real estate with a transfer-on-death deed are considered non-probate assets and pass directly to the beneficiary without being subject to creditors’ claims and expenses of estate administration.

If you have questions about the probate process or concerns over how the administration of an estate is being handled, please call (713) 909-7323 or contact us online today.

Frequently Asked Questions About Probate

Do I Need an Attorney to Probate a Will in Texas?

In Texas, if you are the executor or administrator of an estate, you are required to be represented by a licensed lawyer. This is because the executor not only represents her or his interests but also those of the heirs and creditors. While Texas does allow individuals to represent themselves in court (as “pro se” or self-help litigants), the state requires that a licensed attorney represent all third-party interests. If a non-attorney represented an estate before the courts, this would be considered the unauthorized practice of law.

How Long Does the Probate Process Take?

In relatively straightforward cases, the probate process takes around six months to a year to complete. However, if the estate is complex or the will is contested, it can take longer. Not being able to locate the decedent's will can also extend the process.

Is There a Time Limit to Complete the Probate Process?

An application to probate a will must be filed within four years of the decedent’s death. Once the probate process has begun, however, there is no deadline by which an estate must be completed in Texas. If an estate is not completed within 15 months, the executor or administrator can, in most cases, be ordered to provide an accounting of all estate assets, debts, and expenses. The executor then has 60 days to provide the accounting. If they don’t, the court can force the executor to provide the accounting.

What Happens When Someone Dies Without a Will?

When a person dies intestate (without a will), probate will be overseen by the courts. During this process, the courts will make an official Determination of Heirship to identify who the decedent's heirs are and their share of the decedent's estate (in Texas, an estate's property is distributed based on whether it is categorized as separate or community property).

The courts will also appoint an administrator for the estate (often an attorney). The administrator will act in the same capacity as a named executor and is responsible for fulfilling the same probate duties, including notifying creditors, submitting an inventory report to the County Clerk, and settling the estate.

What if the Decedent Was in Debt or Owed Money?

It is not uncommon for people to die with outstanding debts. Common debts include mortgages, medical bills, credit card debts, and personal loans. When someone dies, their creditors are notified as part of the probate process. A notice to creditors is required by law and allows creditors the opportunity to file a claim against the estate. In Texas, the requirement to notify creditors can be satisfied with a notice posted in the local newspaper. The executor or administrator of the estate will be responsible for discharging creditor claims using assets from the estate.

What If a Business Is Included in the Estate?

When a deceased person's estate includes business interests, a business law attorney can help you facilitate business valuations and enactment of business succession plans for family limited partnerships and other businesses. Unlike many probate or estate planning law firms, Hendershot Cowart P.C. includes a renowned business law practice, giving us the insight and experience to handle any type of estate administration issue involving businesses and other high-value assets – whether your goal is to continue the family business, liquidate assets, or divide business interests fairly.

Does Every Estate Have to Go Through Probate?

No, not every estate is subject to probate. Small estates, or those valued at $75,000 or less, do not have to go through the probate process. Instead, heirs can opt to file a Small Estate Affidavit. Additionally, not all property is subject to probate. For example, jointly held property and life insurance properties with a named beneficiary do not have to go through the probate process.

A skilled probate lawyer can help with the probate process in many ways, including assisting an executor/administrator in fulfilling their responsibilities and providing guidance if/when a will is contested or when there is a dispute between beneficiaries or heirs.

If you have recently lost a loved one and need help with the probate process in Harris, Fort Bend, Galveston, or Montgomery Counties in Texas, please contact our law firm today or call us at (713) 909-7323.